Let’s face it – no one likes being broke. But it just so often happens that we find ourselves on our last penny under a huge pile of debt. It can be a stressful scenario for anyone, especially for families with little kids around. Our minds go numb and we can’t think of any way to get out of our dilemma.

We feel you. That’s why in this article we’ll be listing several ways through which you can easily pay off your debt if you are broke. Read the article till the end so that you don’t end up missing out on anything.

1. Don’t make minimum amount payments

Many people who are in debt create a flawed finance plan in which they decide to make loan payments that are just above the minimum amount threshold. This is wrong. While you temporarily pay less, the debt that you could have paid off adds up and increases the duration of the loan.

So now, you are actually paying more because of the interest over a longer period of time. That’s why we recommend paying off as much as possible each month to decrease the loan period.

2. Get a lower interest rate for your loans

If your loans happen to have extremely high-interest rates, which is often the case with credit card debt and payday loans, then you should consider lowering it down before you start making payments. If you have a good credit score and practice good credit habits, then consider asking your creditor if they will lower the interest rate.

If that doesn’t work, avail of the services of debt consolidation or credit refinancing programs. There are various sites that offer this like Credit9 and you can consider checking the integrity of these sites at Credit9 Review if you wish.

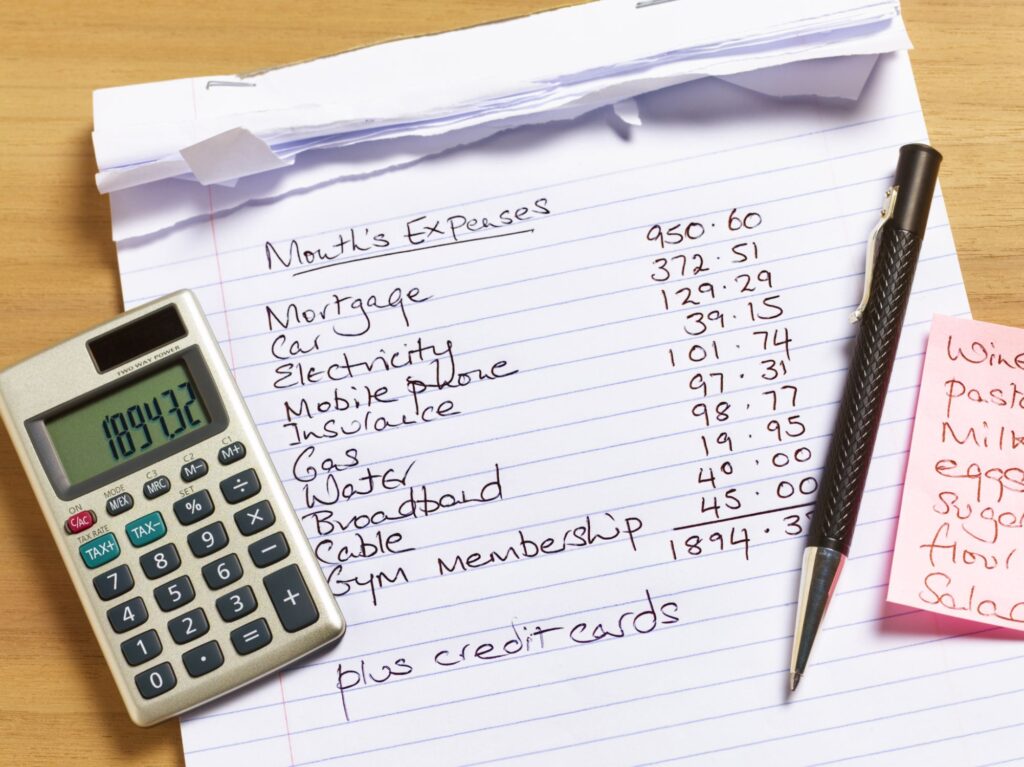

3. Create a budget and ensure the expenditure is below the limit

This is crucial advice for people who frequently find themselves out of money. Plan out a budget for your bare necessities and wants, and see how much money you can spare aside for paying off your debts. You’d be surprised how streamlined the process becomes when you write down the budget on paper. Ensure that you keep some emergency amount for your household each month in case of sudden adversity.

4. Earn more and make repayment a priority

This may be pretty obvious to some people, but for others, not so much. If you want to get rid of your debts, you need money. And even if your current salary is paying off the monthly payments at a steady rate, you should still consider a part-time hustle to increase your income. However, it is important to know that this may not be a good choice for many people, especially who already work 16-18 hours on all days.

But if you can manage it, then you definitely should. All skills have a market value and if you can freelance yours, then you might be able to generate a positive income for your family. You can also use your pre-existing assets for extra money, like selling off old things you don’t use or renting your property to individuals.

Conclusion

There are several ways to pay off debt if you are broke and we hope this article provided insights on some of them. If it did, please consider following our website for regular updates as it will help us out immensely.